¿Por qué Colegio Borja?

Competente, consciente, comprometido, compasivo y creativo

Dar lo mejor de uno mismo y compartirlo con los demás es fundamental. Crecer por medio de la cooperación es un aprendizaje tanto para la vida profesional como para lo personal.

Centro de una línea

Atención individualizada. Familiaridad. Creciendo junto a ellos. Etapas educativas: infantil, primaria y secundaria.

Espacios abiertos y verdes

Patio equipado para la práctica de futbito, baloncesto, volleyball, patinaje, zona infantil.

Metodología variada

Nuevos procesos de enseñanza-aprendizaje. Aprendiendo con los sentidos. Curiosidad. Creatividad. Trabajo cooperativo.

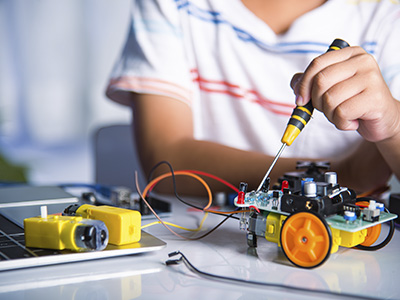

Tecnología al servicio

Alumnos tecnológicos para un mundo tecnológico, con sentido crítico. Google for education. TV táctil. Robótica en el aula.

Ubicación única

En el centro de Gandía, en el palacio ducal

El Colegio Borja está situado en el Palau Ducal, edificio histórico que proporciona variedad de espacios. Su ubicación es en el centro histórico de la ciudad junto a un parking de fácil acceso.

Oferta educativa

Infantil

De 2 hasta los 6 años

Primaria

Desde los 6 años

Secundaria

Desde los 12 años

Extraescolares

Infantil y primaria

Red Nacional de Centros

68 centros Jesuitas por toda España. Estamos en 31 ciudades y 27 localidades.

La educación jesuita, con más de cuatro siglos y medio de experiencia, se basa en la Pedagogía Ignaciana cuya clave es enseñar a pensar y enseñar a aprender. Se plasma en sus colegios y universidades.